mass tax connect estimated tax payment

Your support ID is. Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue.

Instructions For Preparing Form F 1120 For 2008 Tax Year R 01 09

Please enable JavaScript to view the page content.

. Download or print the 2021 Massachusetts Form 355-ES Corporate Estimated Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Keep an eye out on our ever-changing frequently updated FAQ page on massgovdor. Your average tax rate is 1198 and your.

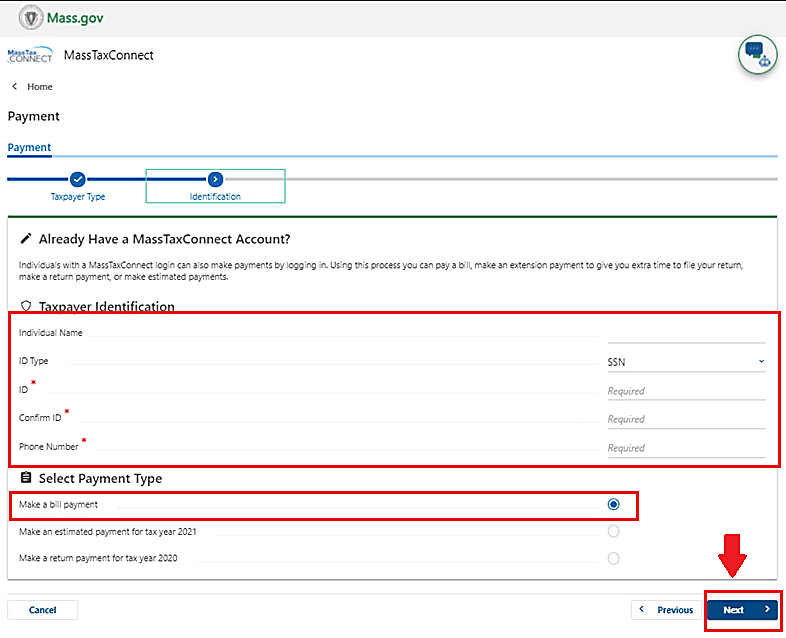

For business and individual taxpayers. Call 617 887-6367 for information on the. Use this link to log into Mass Depa.

Learn what e-filing and payment options are available and what. Your support ID is. 40 of estimated tax is due on or before.

Corporate estimated tax installments are due as follows. Payments must have the status Submitted to be deleted. E-filing is the fastest way to file your Massachusetts personal income tax return and get your refund from DOR.

Your support ID is. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. This video tutorial gives you an overview of the MassTaxConnect system including how to set up an account andor log in.

Massachusetts Income Tax Calculator 2021. Your support ID is. The Massachusetts Department of Revenue DOR replaced their existing e-filing system WebFile.

Select the Returns hyperlink to choose the. Please enable JavaScript to view the page content. Read on for a step by step guide on making tax payments in MA.

This video tutorial shows you how to make an estimated payment in MassTaxConnectSubscribe to DOR on Social. ONLINE MASS DOR TAX PAYMENT PROCESS STEP 1. Paid in four installments according to the schedule below.

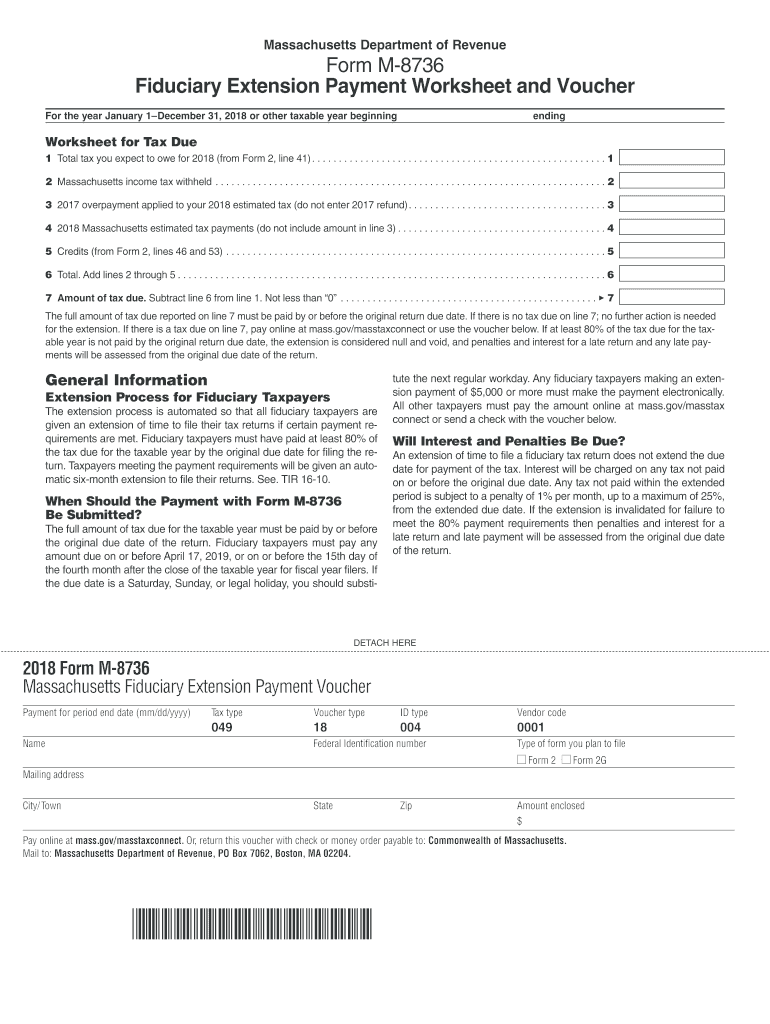

Visit DOR Personal Income and Fiduciary estimated tax payments for more. Mass tax connect make estimated payment Thursday June 23 2022 Edit. Payments with a status of Is in Progress or Completed cannot be deleted.

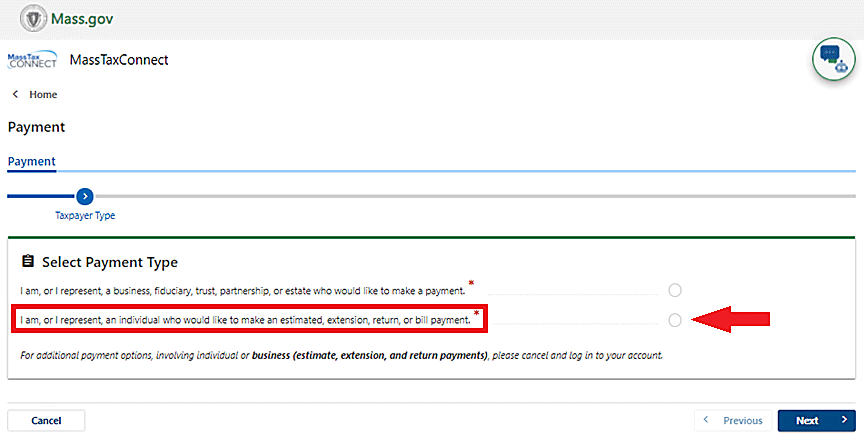

Select Payment Type choose Return Payment for year 2019 if paying the balance. Individuals and fiduciaries can make estimated tax payments with MassTaxConnect. Select the account type that you are making a payment on.

Download or print the 2021 Massachusetts Form 355-ES-2019 Corporate Estimated Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Youll learn how to pay a tax bill or make an extension. Please enable JavaScript to view the page content.

Log in to MassTaxConnect. Please enable JavaScript to view the page content.

These States Are Sending Stimulus Checks To Residents Fortune

Add Authorized User To Masstaxconnect Draughts Ledgers Ltd

Massachusetts Income Tax Calculator Smartasset

Dor Notices And Bills Mass Gov

What Happens If You Miss The Income Tax Deadline Forbes Advisor

Massachusetts Graduated Income Tax Amendment Details Analysis

Every Tax Deadline You Need To Know Turbotax Tax Tips Videos

Millions Of Mass Taxpayers Will Get Money Back Starting In November Officials Say Here Are The Details The Boston Globe

Dor Notices And Bills Mass Gov

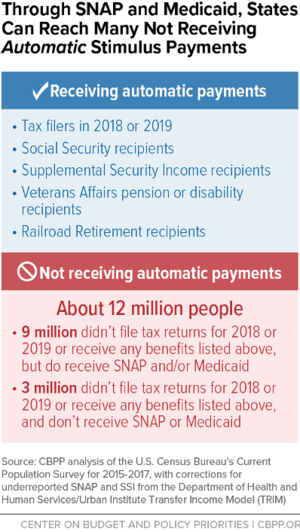

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities

Massachusetts Rhode Island Natp Chapter Making 2018 Estimated Payments For Individual Taxpayers On Masstaxconnect

Baker Tax Refunds To Start In November

Dor Tax Due Dates And Extensions Mass Gov

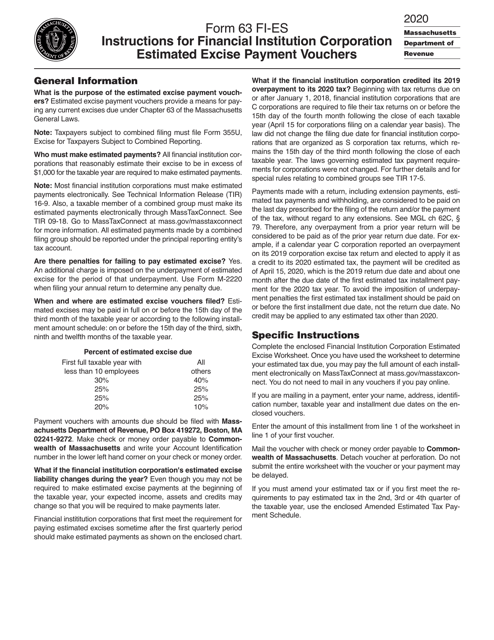

Form 63 Fi Es Download Printable Pdf Or Fill Online Corporate Estimated Tax Payment Voucher 2020 Massachusetts Templateroller

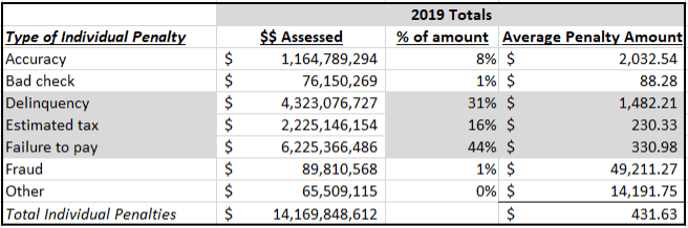

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

E File And Pay Your Ma Personal Income Taxes Mass Gov